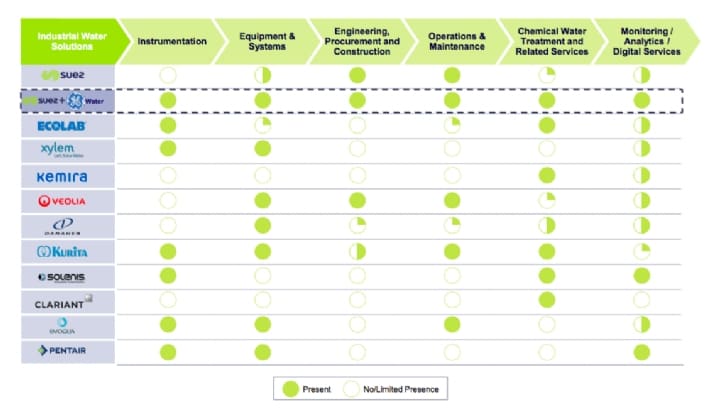

Suez’s audacious move to outbid all comers to acquire GE Water introduces a new dynamic to global desalination and reuse markets. What do people think of the deal?

1. Surprise!

Suez as buyer took the industry by surprise. Most people did not expect a water company to have enough financial firepower to acquire GE Water. An industry buyer is welcomed as positive, however, and the signs are that GE Water will continue to operate as an autonomous, standalone unit, and that Suez’s industrial business will be integrated into the GE model. GE Water president and chief exeuctive Heiner Markhoff is said to be meeting with the Suez top team in Paris this week.

2. Good for Suez …

The deal is seen as a great match for Suez. It provides Suez with, among other things, a very established footprint in the Americas. And, GE Water brings to Suez certain technologies that Suez did not already offer, particularly in industrial sectors, including oil and gas.

3. … And for GE Water

The outcome is considered broadly positive for GE Water, too. It was strapped previously by reporting into a huge corporate accounting structure in which it risked comparing unfavourably to other divisions. That said, rebranding the business to Suez — which is set to happen after the deal closes around mid-year — is a big change of identity for staff and customers.

4. Consolidation

A small amount of consolidation is to be expected. There are some areas of overlap between the two businesses, such as in municipal markets, and plant operations and maintenance.

5. A full price

The big question still to be answer is was GE Water worth €3.2 billion? In a market a challenging as water, certainly Suez has its work cut out to generate €3.2 billion worth of value out of the deal.