There is a big shift going on in the water sector, and it’s exemplified by the Suez-GE deal. While the focus of services offered by engineers has always ebbed and flowed along a spectrum of consultancy, design work, systems integration, and delivery, nowadays customers’ decision-making processes are pushing at the boundaries of these traditional project service offerings.

Within both the municipal and industrial water markets, and across the globe, clients want their projects to take account of a much wider range of economic, environmental, and social issues than they did in the past. This demands a super-flexible approach, and an ever-broader range of services from EPCs.

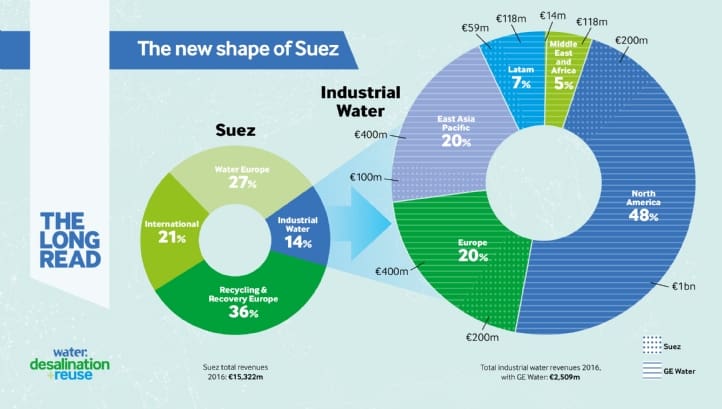

In the case of Suez-GE, the focus of the deal is industrial water markets. It will result in formation of a new company comprising GE Water, and the industrial water business of Suez. This effectively brings together Suez’s expertise and global footprint in project design, delivery and operations, with GE Water’s systems and product portfolio. It’s a potentially formidable combination.

Suez anticipates revenue synergies of €200 million a year from “cross-selling industrial water activities leveraging on the Suez geographical footprint”. Further, it expects to realise cost synergies of €65 million a year in earnings before interest, tax, depreciation, and amortisation (EBIDTA), from manufacturing, engineering, service operations, purchasing, and sales and general administration.

The range of products and services that the new company now offers additionally includes GE Water’s cloud-based asset management software, InSight, currently in use at 4,000 customer sites globally, and supporting 40,000 connected assets, which Suez describes as “driving client retention”. The list of blue chip clients on the roster boasts the likes of Intel, and Johnson & Johnson, Pfizer, and Shell Oil, to name a few.

The offerings of this newly formed company (the exact name will be revealed later this year), are broad-ranging, propelling Suez into a leading position in global industrial water markets, including particularly the reuse segment.

‘Widespread interest’ in water from investors

Water sector consultancy Bluefield Research president Reese Tisdale, in his April 2017 analysis of global water sector mergers and acquisitions in 2016, argues that having 72 parties reportedly want to run the rule over GE Water demonstrates “a widespread focus” on the US and industrial water markets. And — notwithstanding US Environmental Protection Agency (EPA) administrator Scott Pruitt’s decision to “review and reconsider” the incoming US coal-fired energy plant wastewater standard known as “the Rule”, effectively putting it on ice — for the most part, environmental protection legislation is driving industrial clients to seek out cost-effective water treatment solutions.

In February, India’s Supreme Court directed the pollution control boards in all 29 of the country’s states to put producers of wastewater (municipal and industrial) on notice that they must install primary effluent treatment plants within three months, or have their power cut off. Further, the central government is working to develop an economy for recycled water. It has signed a memorandum of understanding with the Ministry of Railways to adopt reuse water for cleaning rolling stock, and for other non-potable uses; and Indian power plants within a 50 kilometre radius of sewage treatment plants must now buy treated wastewater.

Is it against the backdrop of these moves that MWH Global, the water sector-focused engineering firm acquired by Canada’s Stantec in March 2016, won a contract to create a water reuse masterplan for India’s most populous city, Mumbai, in May 2017.

That Stantec acquisition “thrust it into a global leadership role for water and wastewater services, overnight,” says Tisdale. The big infrastructure engineers certainly look to be interested in water, and that includes eyeing the opportunities in the rapidly growing water reuse market, particularly in the US, India, and China. MWH Global is a 6,800-person engineering, consulting and construction management firm focusing on water and natural resources for the built environment. It has 187 offices in 26 countries, including a strong presence in the UK, Australia, New Zealand, South and Central America, US, and the Middle East. Bob Gomes, Stantec president and chief executive officer, explains the deal thus: “MWH brings new geographic presence, acclaimed industry reputation, and most importantly, shared values in its dedication to communities.”

Integrators are vital in new paradigm

Those shared values regarding “dedication to communities” may sound a bit vague, but Gomes’ comment speaks to the emerging culture around water projects that is challenging engineers to become more widely capable, and adept at managing the needs of multiple stakeholders. In its March 2017 white paper, ‘Water Futures: Water, Energy and Agriculture to 2035’, MWH Global argues that in water, the new paradigm for infrastructure design is distributed networks, comprising both large scale hubs and smaller, modular facilities. “Similarly to centralised energy, centralised water solutions are inefficient, unsustainable, and highly vulnerable to climate change,” the paper argues. In this new design paradigm, water, energy and agriculture become less centralised, and interrelate more directly with one another to form distributed networks whose role within communities is multi-faceted.

“Systems integrators, bringing together design and innovative technology, will support distributed networks.”

Water Futures: Water, Energy and Agriculture to 2035 – MWH Global white paper

An important feature of this new infrastructure design paradigm is that it envisages an increasingly pivotal role for systems integrators. “Systems integrators, bringing together design and innovative technology, will support distributed networks,” the report states. As client demands for design and delivery around distributed and, most likely connected, networks, are shaping up in this new way, providers are increasingly looking either to amass a breadth of technology in-house, or to build up their capabilities in managing collaborative partnerships with external tech providers.

Hitachi Zosen’s acquisition of Osmoflo, which completed in March 2017, reflects the drive for EPCs to broaden their services and technology offerings. Through it, Japan’s Hitz has gained access to Osmoflo’s desalination and membrane-based industrial water treatment solutions, to add to its established global position in thermal desalination. As Hitz puts it: “The transaction will enable integration of Osmoflo’s technology, especially reverse osmosis, with Hitachi Zosen’s plant engineering technology and experience in the multi-stage flash method. We believe that this will further enhance the combined companies’ opportunities in desalination and industrial water treatment, in overseas markets including the Middle East.”

‘With Hitz’s support for our R&D and business network, we can truly become a global business.’ Osmoflo CEO and managing director, Emmanuel Gayan

On the other side, Osmoflo sees the deal as providing significant growth opportunities, particularly as it enables the Australia-based business to tap into Hitz’s large international network, and to offer to the market a substantially increased range and size of solutions. Further, Osmoflo opened a new innovation centre, The Edge, in south Australia in March 2017, backed by its new parent company. “With Hitz’s support for our research and development, and business network, we can truly become a global business with the ability to replicate our Australia successes around the world,” says Osmoflo chief executive and managing director, Emmanuel Gayan.

Culture of collaboration will drive projects

As well as building up their capabilities to integrate multiple technologies, firms are increasingly looking at collaborations with third parties, which may be digitally enabled. GE Water has developed several partnerships in collaborations that leader of business development, digital water, Steve Davis, describes as “outside of the fence”. They include joint app development projects with WaterSmart Software, and Smart Earth Technologies, which will see the third parties develop applications on GE Water’s in-house platform, InSight, echoing similar collaborative arrangements pioneered by the tech giants of Silicon Valley, US. The two digital developer partners are focusing on customer communication and engagement apps to enable individuals, communities, and utilities to understand, manage and control water consumption habits better.

The culture of project development and delivery itself has also arguably taken on a more collaborative tone over the past few years, particularly in the municipal sector. The Carlsbad Desalination Plant Project, situated in Carlsbad, San Diego County in California, and which completed in December 2015, is often held up as a shining example of good project design and delivery (the EPC contractor was IDE Technologies); and Carlos Riva, chief executive of the project’s developer, Poseidon, has spoken of spending “a lot of time attending the public meetings”.

As part of growing its capabilities in managing community relations, Poseidon has learned to operate with a high degree of transparency, and to involve customers in the conversation, often through the utility, and has honed its skills in public relations outreach. Poseidon is currently developing a second large scale desalination project in southern California, further along the coast from Carlsbad in Huntington Beach, Orange County.

Political research consultancy Tulchin Research, based in San Francisco, in May 2017 published the results of a survey into California voters’ attitudes towards desalination, which show that 56 per cent “strongly favour” and 34 per cent “somewhat favour” efforts by the state to approve desalination projects. The result showing that 31 per cent are “much more likely” to vote for a candidate for elected office if they support desalination, and 46 per cent are “somewhat more likely,” may have influenced those senior state politicians who subsequently called on the California Coastal Commission to approve the new facility, including California Assembly speaker Anthony Rendon, and State Senate president, Tem Kevin de León.

Proposals for project governance

A new project culture that emphasises community communication and influencing, and consensus-building, is articulated in the March 2017 report, ‘A new model for water access — a global blueprint for innovation’, published by the Global Water Leaders Group, the successor to the UN Global Agenda Council of Water 2014-2016, whose work forms the basis of the paper.

The report, which puts a focus particularly on projects outside of the high income economies of Europe, North America, and Asia Pacific, argues for a new model for water infrastructure projects: “It begins with a social contract. The first step is to bring together the stakeholders to identify the benefits they will receive as a result of improved access, and to commit to the actions required to deliver the results.” The other four steps in the new model comprise local design; decentralising with facilities like water kiosks and micro-utilities to cut up-front capital costs; use of micro-credit and short billing cycles to support low income households unable to save up larger capital sums; and cost-saving innovations.

The report goes further, proposing a new model for project governance that would include a project board comprising the community, central and local government, businesses, utilities, non-governmental organisations, and other solutions providers. “The project governance model brings together all potential solutions providers, and aims to ensure co-ordinated solutions across the entire water and sanitation space,” it states.

These state-of-the-nation reports on water infrastructure both discuss the challenges of investment, and the related requirement for cost-saving innovations. MWH Global quotes estimates of funding requirements for water infrastructure up to $90 trillion to 2030. “Over the last decade, investment in utilities and infrastructure business has shifted and is now highly globalised, as sovereign funds and long-term wealth managers in particular have sought out steady income in the face of fragile, low return markets. Cross-border ownership is the norm in many markets,” it says.

For its part, the Global Water Leaders Group report warns of a potential withdrawal of economic and political support for water infrastructure investment by the middle classes; as well as demonstrating how utilities’ failure to upgrade and renew assets is leading to degradation of services over time. The report states that outside Asia Pacific, Europe, and North America, $217 billion a year is spent on water and wastewater utilities, but that the additional costs of inadequate access to water — including ill health and loss of time through fetching supplies — amount to $323 billion. “Borrowing from the future health of the network is a false economy because a well maintained system is also the cheapest system to operate,” it argues, adding “ideally, utility spending should be fixed so as to cover best practice in operations and maintenance, capital renewal, capital investment required to meet changing circumstances, and capital investment to facilitate the extension of the service to new customers.”

All this results in a spotlight on design, delivery and technology solutions that respond to customers’ concerns and put cost efficiency front and centre. As they shape up to service the water sector of the 2020s and beyond, to support healthy communities and economies, the leading EPCs are looking to collaboration, new design paradigms, and the capability to offer and integrate a range of innovative technology solutions.

The deals that changed the EPC landscape in desal and reuse

Suez/CDPQ-GE Water

| People |

Jean-Louis Chaussaude, Suez CEO |

| Deal date |

Completes mid-2017 |

| Shareholdings |

70 per cent Suez |

| Price |

€3.2 billion ($3.4 billion) |

| Strategic rationale |

The deal combines Suez’s expertise and global footprint in project design, delivery and operations, and GE Water’s systems and products portfolio, and expects to result in significant cost and revenue synergies. |

Stantec-MWH Global

| People | Bob Gomes, Stantec president and chief executive officer Alan Krause, MWH chairman and chief executive officer |

| Deal date | Completed May 2017 |

| Shareholdings | MHW Global is now wholly-owned by Stantec |

| Price | $793 million |

| Strategic rationale | The deal aims to create a global leader in water and infrastructure markets, expands Stantec’s geographic footprint, enhances cross-selling capabilities, creates additional growth opportunities, adds water-related construction capabilities, and offers new opportunities to employees. |

Hitachi Zosen-Osmoflo

| People | Takashi Tanisho, president and chief executive officer, Hitachi Zosen Emmanuel Gayan, managing director and CEO, Osmoflo |

| Deal date | Completed March 2017 |

| Shareholdings | Hitz acquired 70 per cent of shares owned by Osmoflo founders Annie and Marc Fabig. The remaining 30 per cent remain with Marubeni Water Australia, a subsidiary of Marubeni Corporation of Japan. |

| Price | Not disclosed |

| Strategic rationale | The transaction is expected to enable integration of Osmoflo technology, especially reverse osmosis, with Hitachi Zosen’s plant engineering technology and experience in multi-stage flash, enhancing opportunities in desalination and industrial water treatment in overseas markets, including the Middle East. |